Payroll statistics 2023 will help you minimize payroll expenses, avoid errors, and boost employee satisfaction. You will better understand payroll trends and the real impact of payroll on your company.

This article includes:

The employment landscape is changing quickly. Thus, you must evolve with the times. What is NOT changing is the necessity to pay your employees, gig workers, and contractors: accurately and on time.

Get inspired with these payroll statistics, prepare in advance, and discover innovative payroll solutions!

Ready to take your payroll to the next level? Download our FREE guide to avoid costly payroll mistakes, assess your payroll, and identify areas for improvement!

Click the links below to go directly to the payroll stats of your interest*:

General payroll statistics 2023

Salary projections

Payroll errors

Payroll technology & automation

Payroll outsourcing

*The information, data, and guidance provided in this article is for general information purposes only and does not constitute professional or legal advice.

Let’s start with general payroll stats and facts.

Payroll has a huge impact on business profitability and employee retention. A company’s administrative and financial operations depend heavily on payroll.

But above all, your employees depend on payroll. If your employees’ (lack of) income affects their security, it will impact their productivity. They can even consider changing their job.

Thus, a solid and reliable payroll process is a must.

54% of companies say there’s room for improvement in their current payroll policies and practices.

EY

Typical pay frequencies (US Bureau of Labor Statistics):

59% of employees say salary is the main factor that contributes to feeling fulfilled in their career.

SHRM

Improve employee retention in 2023 with this HR Planner!

HR Calendar 2023: Download Now

The current recession is challenging. Many companies are struggling to retain and engage their employees as inflation rises.

According to a study by Willis Towers Watson (WTW), many organizations are considering price increases and layoffs to increase pay and retain top employees.

WTW’s study included 1,550 companies across different sectors in the USA. Around 28,000 sets of responses were received from companies across over 135 countries worldwide.

Key takeaways from WTW’s study:

US wages may climb 4.6% in 2023 (the fastest increase in 15 years). Employers catch up with accelerating inflation and try to retain their employees amid a tight labor market.

WTW

Other salary projections and data:

Businesses are also trying to find ways to retain workers besides higher pay, such as providing workplace flexibility or improving employee experiences and engagement. This has to do with changing employee expectations.

Download our HR Calendar 2023 to boost your employee engagement every day!

Many businesses’ salaries still need to catch up to the inflation rate. It’s essential in an increasingly competitive labor market.

Organizations of all kinds, from global multinationals to modest enterprises, plan salary increase budgets to maintain the workforces they need.

Sue Holloway, director of executive compensation strategy at WorldatWork

The reality is that labor demand is strong, and labor supply hasn’t returned to pre-pandemic projections.

To tackle the competitive labor market (WTW):

The key decision drivers in setting pay budgets for 2023 include:

Depending on the inflation rate in 2023, employers might be forced to raise their salary budget projections next year (assuming they have sufficient revenues).

Some employers plan to revise salary structures (including pay ranges) upward to achieve pay goals. Some have to reduce their budget increases if the economy slows down significantly.

Download our Gig Economy Guide to get ready for the future of work and new employment trends. Cut down costs in the economic recession!

Gig Economy Guide: Download Now

Payroll errors can cost businesses time, money, and legal consequences, e.g. due to confusing tax laws and complex employment laws.

Additionally, employees expect to get paid accurately and on time. Otherwise, no matter the rest of their experience with your company, they will get frustrated and disengaged. Payroll errors and delays can even motivate them to change their jobs.

Miscalculating pay can result in:

It can take only 1 wrong digit in payroll calculation to result in inaccurate paychecks and potential tax errors.

The bottom line: it’s worth avoiding costly payroll mistakes at all costs.

Additionally, according to the survey by SD Worx:

49% of employees will start looking for a new job after experiencing only 2 problems with their paycheck.

The Workforce Institute, Kronos Incorporated

Avoid costly payroll errors, assess your payroll, and identify areas for improvement with our FREE payroll guide!

Today streamlined HR & payroll processes, and a consistent employee experience are essential. Detailed bookkeeping and file tracking systems are important, and modern HR technology makes it easier.

Using spreadsheets to manage payroll manually is outdated and inefficient. There’s also the risk of payroll errors. This is where automation comes to the rescue.

Automation can reduce time-consuming and repetitive tasks in HR & payroll departments to the barest minimum. It can also provide employees with convenient and flexible self-service solutions.

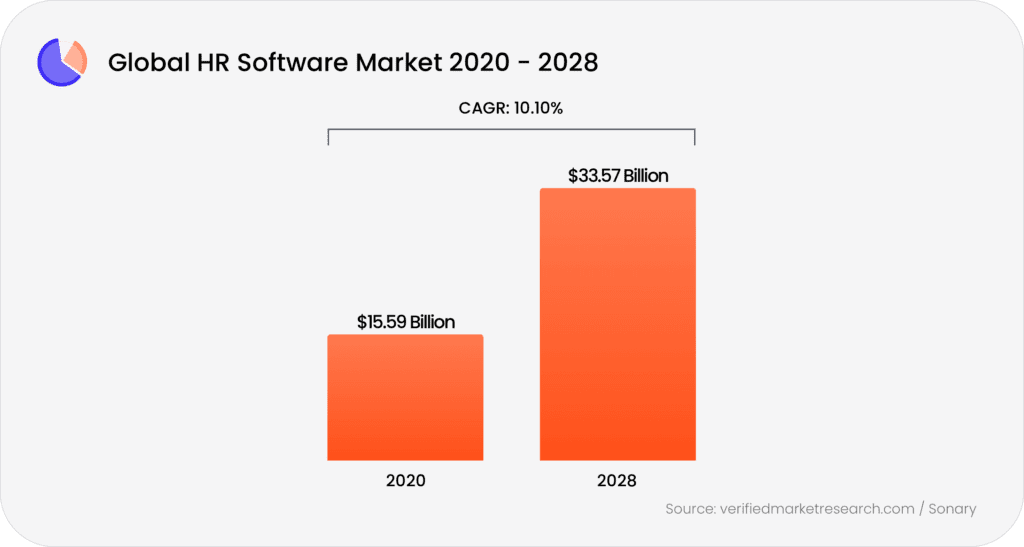

As a result, the HR software market is growing. It’s expected to reach 33.57 billion by 2028 (from 15.59 billion in 2020, a growth rate of 10%) (Verified Market Research).

Consider the top 4 HR service providers worldwide (rankings from HRoot):

Now consider the top 4 HR service providers for profitability (HRoot):

Many of those companies are payroll service companies.

29% of businesses use a payroll system that is 10 years old or older.

Kronos, American Payroll Association

According to Workato’s payroll and benefits automation data:

HR & payroll automation can help businesses of various sizes.

Today modern HR & payroll solutions can help:

Symmetrical offers easy, automated payroll services with the support of a dedicated team of payroll experts to help you reduce payroll mistakes and improve your payroll system.

Watch the video below about 11 HR trends for 2023 that will shape the future of HR, including combining automations with humans.

https://www.youtube.com/watch?v=qJYFRHgAs8Y

Outsourcing payroll can save businesses 18% (vs. companies handling payroll themselves).

PWC

Paying your employees accurately and on time is the unchanging aspect of payroll & HR.

Still, you must be on top of payroll trends and the latest payroll-related data (and of course, laws and regulations).

The latest payroll statistics can help you:

Ready to take your HR and payroll to the next level?

Symmetrical is a better way to run payroll and HR admin. We offer easy, automated services with the support of payroll experts to help you:

How Much of Gross Revenue Should Go to Payroll?

20+ Engaging Payroll Statistics

The Risks of Poor Payroll for Businesses

Employment Projections: 2021-2031 Summary

Number of people 75 and older in the labor force

25% of Small Businesses Still Record Finances On Paper

HR Statistics: Job Search, Hiring, Recruiting & Interviews

Human Resource statistics to know in 2023

50 HR Statistics to Boost Hiring and Retention in 2023

38 Interesting Payroll Facts and Statistics

US talent shortages

Labor Statistics for 2022

US Wages May Rise at Fastest Pace in 15 years in 2023

2023 Salary Budgets Projected to Stay at 20-Year High

U.S. pay increases to hit 4.6% in 2023

U.S. pay increases to hit 4.6% in 2023 (WTW)

U.S. Talent Shortages at Ten Year High

Salary Budget Survey

18 HR automation statistics that stand out in 2023

Why I’m Passionate About Payroll